AI and Machine Learning in Banking Software

Table of Contents

The rapid advancements in artificial intelligence (AI) and machine learning (ML) technologies have revolutionized various industries, and the banking sector is no exception. AI and ML have emerged as powerful tools that enable banks to enhance customer experiences, streamline operations, and improve risk management. This article explores the applications and benefits of AI and ML in banking software. It delves into the ways AI and ML are transforming customer engagement, fraud detection, risk assessment, and process automation. Additionally, the article discusses the challenges and considerations for implementing these technologies in the banking industry and provides insights into the future outlook of AI and ML in banking.

Introduction to AI and Machine Learning in Banking Software

Understanding AI and Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) have become buzzwords in nearly every industry, and banking is no exception. But what exactly do these terms mean? AI refers to the development of computer systems that can perform tasks that typically require human intelligence, such as decision-making and problem-solving. Machine Learning, on the other hand, is a subset of AI that focuses on developing algorithms that allow computers to learn and improve from experience without being explicitly programmed.

Evolution of AI and Machine Learning in Banking

The use of AI and Machine Learning in banking is not entirely new. In fact, banks have been utilizing these technologies for decades, mainly for automating tedious processes and improving operational efficiency. However, recent advancements in computing power and data availability have enabled more sophisticated applications of AI and Machine Learning in banking. Today, banks are leveraging these technologies to enhance customer experience, improve fraud detection and prevention, and optimize risk management.

Key Applications of AI and Machine Learning in Banking

Personalized Customer Engagement

One of the most significant benefits of AI and Machine Learning in banking is the ability to provide personalized customer engagement. By analyzing large volumes of customer data, banks can gain insights into individual preferences, behaviors, and needs. This information allows them to deliver tailored recommendations, targeted marketing offers, and personalized customer service, ultimately enhancing the overall customer experience.

Fraud Detection and Prevention

Fraud is a major concern for banks, and AI and ML are proving to be valuable tools in combating it. These technologies can analyze vast amounts of data from various sources, such as transaction history, customer behavior, and external risk indicators, to detect suspicious patterns and anomalies in real-time. By continuously learning from new data, AI and ML systems can adapt and improve their fraud detection capabilities, helping banks stay one step ahead of fraudsters.

Risk Assessment and Management

AI and ML are also being utilized to optimize risk assessment and management processes in banking. By analyzing historical data and market trends, these technologies can help financial institutions identify potential risks and predict their impact on the business. This enables banks to make more informed decisions when it comes to lending, investment strategies, and regulatory compliance, ultimately reducing financial risks and enhancing overall stability.

Enhancing Customer Experience through AI and Machine Learning in Banking

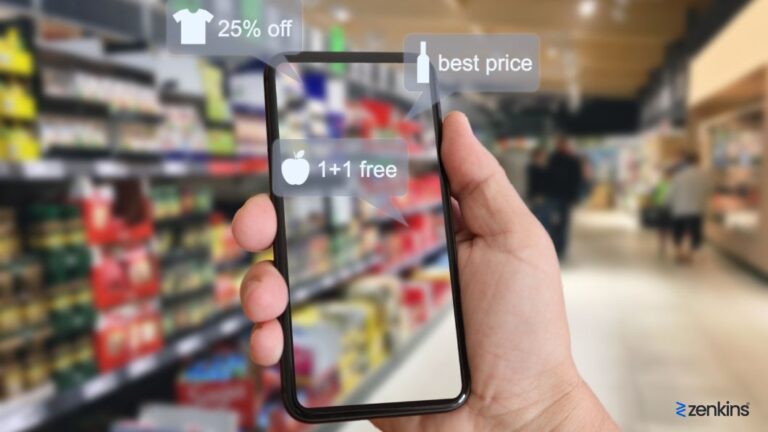

Customized Product Recommendations

Gone are the days of generic product recommendations. With AI and ML, banks can now offer customized product recommendations based on individual customer preferences and financial goals. By analyzing transaction history, spending patterns, and market trends, banks can suggest the most suitable financial products, such as loans or investment opportunities, to their customers, making the decision-making process easier and more personalized.

Chatbots and Virtual Assistants

Say goodbye to long waiting times and frustrating phone calls. AI-powered chatbots and virtual assistants are revolutionizing customer service in banking. These intelligent systems can understand and respond to customer queries in real-time, providing instant support and information. Whether it’s checking account balances or resolving simple issues, chatbots and virtual assistants offer a seamless and efficient customer experience, available 24/7.

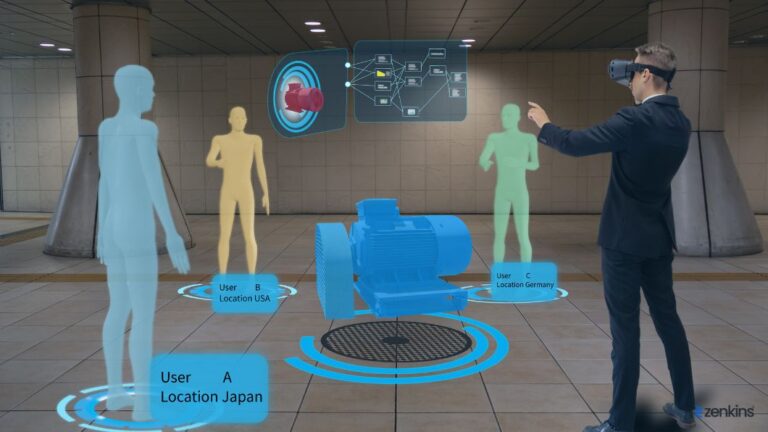

Seamless Omni-Channel Experience

Customers today expect to engage with their banks across multiple channels seamlessly. AI and ML technologies help banks deliver this omni-channel experience by integrating data from various touchpoints and providing a unified view of the customer. Whether a customer contacts the bank through a mobile app, website, or in-person, their preferences and interactions are seamlessly synchronized, ensuring a consistent and personalized experience.

Improving Fraud Detection and Prevention with AI and Machine Learning in Banking

Real-Time Transaction Monitoring

AI and ML enable banks to monitor transactions in real-time, allowing them to detect potential fraudulent activities as they occur. By analyzing patterns, anomalies, and various risk indicators, these technologies can identify suspicious transactions and flag them for further investigation. This proactive approach helps minimize losses and mitigate the impact of fraud on both customers and the bank.

Anomaly Detection and Pattern Recognition

AI and ML algorithms excel at detecting anomalies and recognizing patterns in vast amounts of data. In the banking sector, these capabilities are crucial for identifying unusual behaviors that may indicate fraudulent activities. By continuously analyzing customer behavior, transaction history, and other relevant data, banks can spot deviations from normal patterns and take immediate action to prevent fraud.

Behavioral Biometrics and Authentication

Traditional methods of authentication, such as passwords and PIN numbers, can be vulnerable to fraud. AI and Machine Learning in banking enable banks to enhance security through behavioral biometrics. By analyzing unique patterns in how users interact with devices, such as typing patterns or touchscreen gestures, banks can create more secure and convenient authentication methods. These technologies offer an additional layer of protection, making it harder for fraudsters to impersonate legitimate customers.

Streamlining Operations and Automating Processes with AI and Machine Learning

Intelligent Document Processing

Ah, the joy of dealing with mountains of paperwork. Fortunately, AI and machine learning are here to save the day. Intelligent Document Processing (IDP) technology enables banks to automate the extraction and processing of data from various documents, such as loan applications, invoices, and contracts. No more endless hours spent manually entering information – machines can now do it for us. It’s like having a personal assistant that doesn’t need breaks!

Robotic Process Automation (RPA)

If you’ve ever wished for a robot assistant to take care of mundane and repetitive tasks, RPA is your dream come true. With RPA, banks can automate processes like data entry, customer onboarding, and even transaction reconciliation. It’s like having your very own army of invisible workers, tirelessly carrying out tasks without complaint. Just remember to treat them with respect, or we might find ourselves in a robot uprising!

Predictive Analytics for Process Optimization

Gone are the days of making decisions based on gut feelings and crystal balls. With AI and machine learning, banks can harness the power of predictive analytics to optimize their processes. By analyzing vast amounts of data, these technologies can provide insights and predictions to help banks make smarter decisions. It’s like having a fortune teller who specializes in maximizing efficiency. Who needs a crystal ball when you have algorithms?

AI and Machine Learning in Risk Management and Compliance

Automated Compliance Monitoring

Compliance can be a tricky business, but AI and machine learning are up to the challenge. Banks can use these technologies to automate compliance monitoring, ensuring that regulations are being followed and any suspicious activities are flagged. It’s like having a trusty watchdog that never sleeps, constantly scanning for any red flags. Who needs Sherlock Holmes when you have AI?

Anti-Money Laundering (AML) Solutions

Money laundering is not just for Hollywood villains anymore. With AI and machine learning, banks can detect and prevent money laundering activities by analyzing patterns and identifying suspicious transactions. It’s like having a super-sleuth detective on your side, sniffing out any shady dealings. No need to wear a trench coat and fedora, though – the algorithms have got it covered.

Credit Risk Assessment

Determining creditworthiness used to be a time-consuming process, but with AI and machine learning, it’s become a breeze. These technologies can analyze vast amounts of data to assess credit risk and make more accurate lending decisions. It’s like having a genius mathematician who can process numbers at lightning speed. Goodbye, lengthy credit approval processes. Hello, instant credit decisions!

Challenges and Considerations for Implementing AI and Machine Learning in Banking

Data Quality and Accessibility

As with any technology, the quality and accessibility of data are crucial for success. Banks need to ensure they have clean, reliable data that can be easily accessed by AI and machine learning algorithms. It’s like building a house on a solid foundation – without it, things can get shaky.

Ethical and Legal Implications

AI and machine learning may be powerful, but we still need to tread carefully when it comes to ethical and legal considerations. Banks must ensure transparency, fairness, and compliance in their use of these technologies. It’s like walking a tightrope – one wrong step, and you could find yourself in hot water. Let’s make sure the robots are the only ones getting into trouble.

IT Infrastructure and Integration

Implementing AI and machine learning in banking requires a robust IT infrastructure and seamless integration with existing systems. It’s like piecing together a complex puzzle – every component needs to fit perfectly to ensure smooth operations. Let’s hope the IT department has a talent for solving puzzles!

Future Outlook: The Role of AI and Machine Learning in Banking

Advancements in AI and Machine Learning Technologies

AI and machine learning are constantly evolving, and we can expect even greater advancements in the future. From improved natural language processing to more sophisticated algorithms, the possibilities are endless. It’s like watching a superhero movie franchise – each installment brings new and exciting powers to the table. We can’t wait to see what the future holds!

Collaboration Between Banks and Fintech Startups

To fully harness the power of AI and machine learning, collaboration between banks and fintech startups is key. By combining their expertise and resources, they can drive innovation and create even more impactful solutions. It’s like a dynamic duo teaming up to save the day – Batman and Robin, but for the financial world. Let’s put those capes on and get to work!

Potential Impact on Jobs and Workforce

With the rise of AI and machine learning, there may be concerns about job displacement. However, it’s important to remember that these technologies are meant to augment human capabilities, not replace them. While certain tasks may become automated, new opportunities and roles will emerge. It’s like shuffling the deck – some cards may change, but the game goes on. So, let’s embrace the future and adapt to the new possibilities that AI and machine learning bring. It’s an exciting time to be in the banking industry!

In conclusion, AI and machine learning are reshaping the landscape of banking software, offering immense potential for innovation and growth. By harnessing the power of these technologies, banks can deliver personalized experiences to customers, proactively detect and prevent fraud, automate manual processes, and effectively manage risks.

However, the implementation of AI and ML in banking also comes with challenges in terms of data quality and accessibility, ethical considerations, and infrastructure requirements. As the technology continues to advance, collaboration between banks and fintech startups can further drive the adoption and evolution of AI and machine learning in the banking industry. With a promising future ahead, it is evident that AI and ML will continue to play a pivotal role in shaping the future of banking software and revolutionizing the way financial institutions operate.

FAQ

How are AI and machine learning transforming customer experiences in banking?

AI and machine learning technologies enable banks to provide personalized customer experiences by analyzing customer data, predicting their needs, and offering tailored product recommendations. Additionally, chatbots and virtual assistants powered by AI enhance customer engagement by providing instant support and guidance across multiple channels.

What role do AI and machine learning play in fraud detection and prevention?

AI and machine learning algorithms have significantly improved fraud detection and prevention in banking. These technologies can analyze vast amounts of data in real-time to identify suspicious activities, detect patterns of fraudulent behavior, and trigger alerts for further investigation. By leveraging AI and machine learning, banks can proactively mitigate the risks associated with fraud.

How can AI and machine learning streamline banking operations?

AI and machine learning offer automation capabilities that streamline various banking operations. Intelligent document processing automates data extraction and processing from documents, reducing manual efforts. Robotic process automation (RPA) automates repetitive tasks, such as account opening or loan application processes. Predictive analytics helps optimize processes by identifying bottlenecks and suggesting improvements.

What are the challenges in implementing AI and machine learning in banking?

Implementing AI and machine learning in banking comes with challenges. Data quality and accessibility are critical factors, as accurate and relevant data is required for effective AI and ML models. Ethical and legal implications, such as privacy concerns and bias in decision-making algorithms, need to be addressed. Additionally, integrating AI and ML technologies into existing IT infrastructure and ensuring seamless integration with legacy systems can pose significant challenges.